Ross McSkimming, abrdn

The global economic rebound following Covid-19 has resulted in a steady earnings recovery, in turn favouring dividend pay-outs, according to abrdn.

Companies in the MSCI AC World Index, for example, paid $1.3trn in excess of dividends in the 12 months ending 31 March, highlighting plenty of opportunities for investors to tap into, the asset manager noted.

“We expect appetite for high dividend stocks to remain robust in particular, as history tells us that high dividend stocks tend to do better in high inflation environments,” said Ross McSkimming, senior investment specialist at abrdn, in an interview with FSA.

“Moreover, those companies that can grow dividends are even better placed. Based on this, a focus on high dividend and dividend growers may be favourable for the second half of this year,” he added.

McSkimming also expects both global earnings and dividends to reach double-digit growth.

Apart from the positive earnings, abrdn points to companies’ cash levels at historic highs, which provide a positive backdrop for companies to pay dividends.

Nonetheless, McSkimming does not advocate investing solely in high dividend-paying companies, and instead to diversify across sectors.

Finding dividends

Dividend payments by global companies have demonstrated resilience against the macro environment – and have even grown in size.

In particular, abrdn identified the energy, materials, real estate and industrials sectors as being more rewarding.

“As bottom-up investors, we scour the universe for dividend-paying companies and have identified steady dividend payers with strong fundamentals in sectors like energy and materials,” said McSkimming.

“Given the current broad base of economic recovery, the companies that stand to benefit will also be diverse by sector,” he explained.

The Aberdeen Standard Global Dynamic Dividend Fund aims to deliver capital growth as well as providing a consistent and sustainable yield.

The fund uses a bottom-up approach where it typically holds 80-100 holdings selected from a global opportunity set.

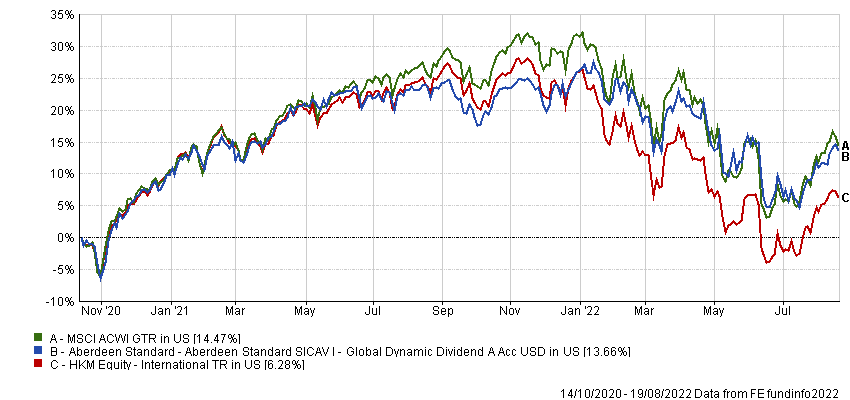

The fund posted a 13.66% cumulative return since its inception in October 2020, compared with the MSCI AC World Index’s 14.47% and the sector average of 6.28%, according to FE Fundinfo.

On the other hand, the year-to-date cumulative return for the fund was -9.91%, while for the sector it was -15.71%.

The fund’s volatility since its inception is 15.15%, according to FE fundinfo.

“Unlike many other global equity dividend strategies in the industry, our strategy is diversified across both value and growth stocks, and also is diverse by country and sector exposures,” said the asset manager.

“Given the uncertainty over whether value or growth will do better in the future, this approach is a neat hedge and provides investors with both structural growth and cyclical growth.”

The fund’s top-allocating sectors include information technology (17.5%), financials (15.4%) and healthcare (13.2%), according to the factsheet.

In terms of geographical allocation, 56.1% of assets are in the US, followed by 5.4% in France, 4.9% in the UK and 3.5% in Germany.

The core sleeve, representing 95% of the portfolio, is comprised 80-100 diversified stocks on a traditional buy-and-hold approach for both yield and capital appreciation purposes.

The remainder of the portfolio is the dividend capture sleeve, which is used to tactically rotate into dividend events and special dividends to generate yield for the fund.

“We review over 1,000 dividend events that are known at least a month before the actual event. We analyse the type of dividend being distributed, potential position size and appropriate time frame against the overall portfolio characteristics and allocations we desire,” McSkimming said.

The fund would also consider special dividends which are more opportunistic in nature and analysed on a company-by-company basis, the asset manager added.