The decade-long run of US equity market outperformance relative to the rest of the world is set to reverse, according to Jeffrey Kleintop, chief global investment strategist at Charles Schwab.

Over the past decade, US stocks have outperformed international stocks by more than twofold – comparing the S&P 500 index return to that of the MSCI World ex USA.

However, after every global economic cycle, there is typically a reversal of US and international outperformance, Kleintop told a media briefing in Hong Kong.

He said: “After a full cycle of outperforming, whatever did well is overvalued, expectations are too high for earnings and it starts to reverse with the start of the next cycle.”

Indeed, there is a historical precedent for this phenomenon. In the 1980s, international stocks outperformed the US, mostly led by Japan up until its bubble burst.

More recently there was a period between 2001 after the dotcom bubble in the US burst where international stocks outperformed again until 2008. Since then, US stocks have led the charge.

Kleintop said he expected this to reverse with the 2020 recession, but the unusual nature of the pandemic-driven sharp recession and rebound delayed it.

During the pandemic, although the service sector shut down, manufacturing and trade boomed – unlike a typical end of cycle recession where both services and manufacturing slow down together.

Kleintop said: “I think we’re in the second half of the recession that happened in 2020 and that’s now finally resetting the clock on performance.”

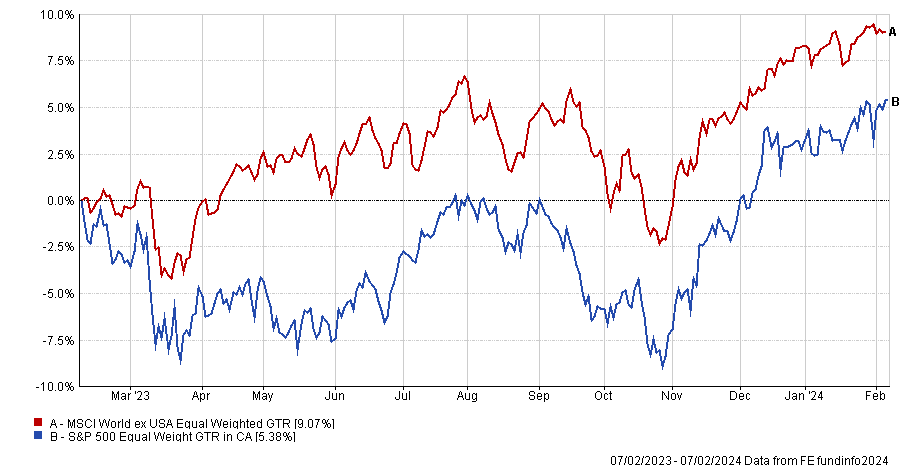

In fact, he argued that US stocks have already started to underperform their international peers, pointing to the performance of equal-weighted indices.

“I think we’re starting to see that transition to the US stock market underperform the rest of the world,” the strategist said.

“Expect more of that to come over the entire next cycle. The gap in valuation is very wide and expectations are very wide. Expect that to work its way out over the next several years.”

In the capitalisation weighted S&P 500 index, performance has been driven largely by the outperformance of the ‘Magnificent Seven’ stocks which rallied on the back of AI-driven enthusiasm.

Kleintop said that the market has already seen a shift to international stock outperformance relative to the US, “it’s just been masked by the incredible performance of these Magnificent Seven AI related stocks which may have a little bit more trouble this year, as the Fed maybe doesn’t cut rates as much as they’re expecting”.

He also argued that a looming slowdown in the services economy will be a headwind for the US equity market, whereas the manufacturing-heavy European and Japanese equity markets will eventually benefit from a re-acceleration in manufacturing.

He said: “If you take those ‘Magnificent Seven stocks’ out of the S&P 500, you’ve got an outlook for negative earnings this year in the US.”

As such, he expects to see a better earnings environment in Europe and Japan than in the US.

“Sentiment is often a contrary indicator”

Kleintop also pointed to sentiment, where in Europe it is very pessimistic.

“They’re in a recession, they’ve got a war on their borders. So they’ve been very, very pessimistic and I think sentiment is often a contrary indicator,” he said.

“When it’s very low as it is right now, there’s room for it to bounce back,” he continued. “I’d expect more money from European investors to move into the markets.”

He also believes that the European Central Bank can cut rates more quickly and more aggressively than the US central bank can, which will mean a return of liquidity to its local stock and bond markets to sustain its outperformance.

He also pointed to a potential shift to more value-orientated factors becoming more attractive in the market.

“Price to cash flow is something that the market is really attracted to right now,” he said. “Companies that have low price relative to their cash flow means they don’t have to borrow in this environment of very high interest rates and tight credit among banks.”

“So that characteristic, in part because of higher interest rates and tight credit banks, is also favoring international stocks,” he added. “There’s more of those companies found in global markets that you’re going to find in the US.”