SECURE YOUR PASS NOW

Join us virtually on 8 March 2022 at the Investment Forum Hong Kong

Company profile

Jupiter Asset Management is a specialist, high conviction, active asset manager. We exist to help our clients achieve their long-term investment objectives. From our origins in 1985, Jupiter now offers a range of actively managed strategies available to UK and international clients including equities, fixed income, multi-asset and alternatives. Independence of thought and individual accountability define us. Our fund managers follow their convictions and seek those investment opportunities that they believe will ensure the best outcome for our clients. They do this through fundamental analysis and research, a clear investment process and risk management framework, with a focus on good stewardship.

Sales contacts

Speaker

Huw Davies

Assistant fund manager, fixed income, Jupiter Asset Management

Before joining Jupiter Asset Management, Huw was an investment director at Merian Global Investors. Prior to this, he was a fixed income product specialist at Ignis Asset Management. Before this, he spent four years working at Citi as director, UK RM interest rate sales and five years at JPMorgan Chase as executive director, interest rate sales. Huw previously worked at Royal Bank of Scotland, UBS, Barclays Capital and Sanwa International, covering UK and European bond sales. He began his investment career in 1991.

Huw has a BSc in economics.

3:05pm – Preparing your fixed income allocation for a higher interest rate and inflationary environment

The 60/40 portfolio strategy, which has served institutional investors well for more than two decades, faces headwinds due to rising inflation and interest rates. As inflation threatens to erode nominal bond returns, we believe a flexible approach that keeps a close eye on the macro environment can stand investors in good stead by delivering:

– Low volatility, mirroring traditional fixed income investments

– Low drawdowns in periods of market volatility

– Diversification for investor portfolios during periods of volatility and protection against negative performance from risk assets

We will also touch upon the importance of integrating ESG criteria particularly when evaluating sovereign issuers.

Strategy profile

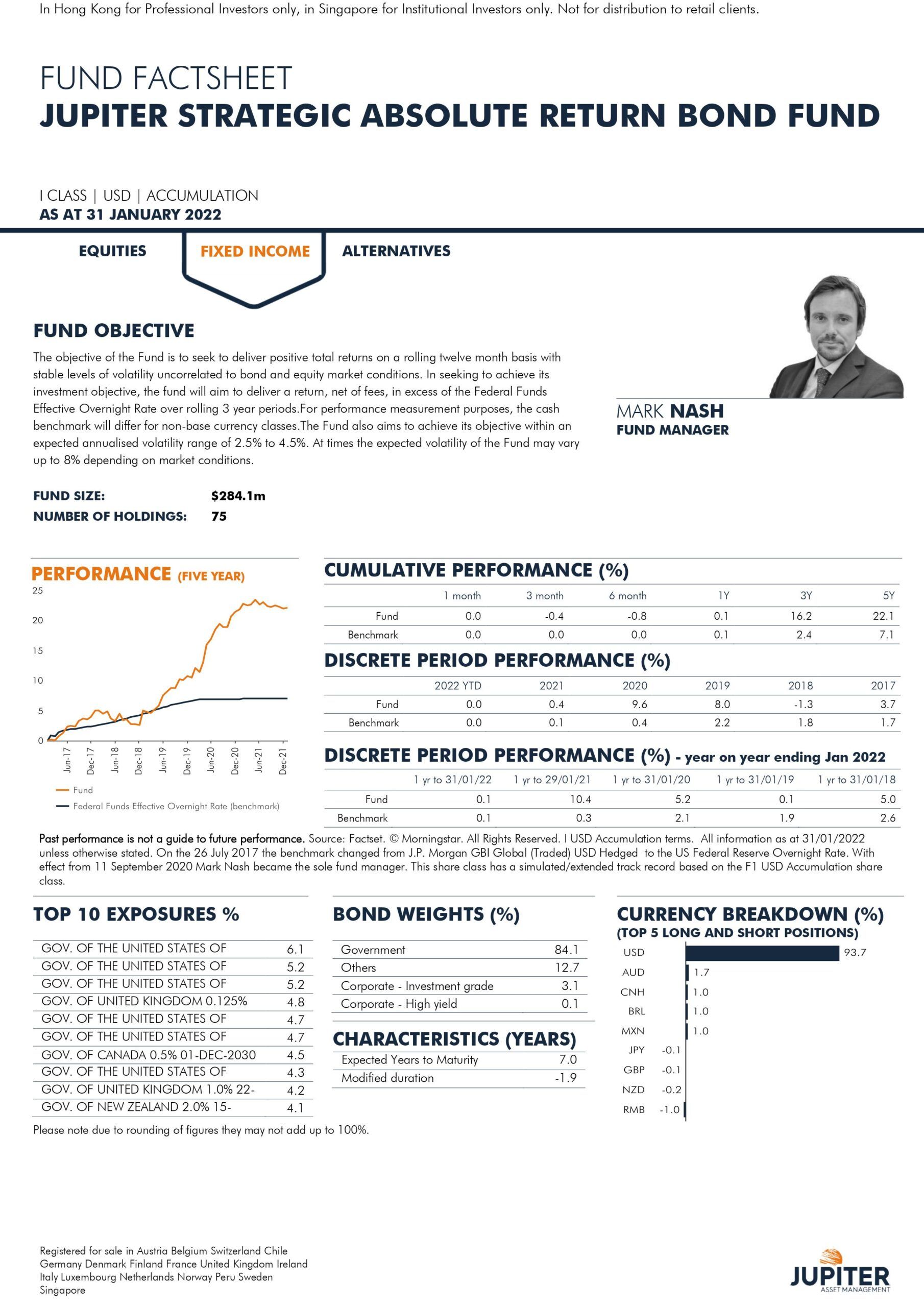

The Jupiter Strategic Absolute Return Bond Fund aims to deliver returns in all market conditions by investing across the full range of the liquid fixed income and currency universe. The team are also able to take short positions, which can often add meaningfully to performance. The fund has no benchmark and targets an average volatility in its portfolio construction.

HONG KONG PROFESSIONAL INVESTOR/SINGAPORE INSTITUITIONAL INVESTOR

Terms and Legal notices:

For Hong Kong Professional Investors:

This webpage is intended only for “professional investors” as defined under the Securities and Futures Ordinance (Cap. 571 of the Laws of Hong Kong). Please ensure you read the Offering Documents for this fund before making an investment decision. These documents contain important information including risk factors and details of charges.

The value of your investment and the income from it can go down as well as up, it may be affected by exchange rate variations, and you may not get back the amount invested. Past performance is no indication of current or future performance. Investment involves risks.

No information in this document should be interpreted as investment advice. You are advised to exercise caution. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This webpage is for information only and is not an offer to sell or an invitation to buy. In particular, it does not constitute an offer or solicitation in any jurisdiction where it is unlawful or where the person making the offer or solicitation is not qualified to do so or the recipient may not lawfully receive any such offer or solicitation. Any holdings and stock examples are used for illustrative purposes only and should not be viewed as investment advice. The views expressed are those of the writer/presenter at the time of preparation and may change in the future. It is the responsibility of any person in possession of this document to inform themselves, and to observe, all applicable laws and regulations of relevant jurisdictions. The information and any opinions contained herein have been obtained from or are based on sources which are believed to be reliable, but the accuracy cannot be guaranteed. No responsibility can be accepted for any consequential loss from this information.

- Investment risk – while the Fund aims to deliver above zero performance irrespective of market conditions, there can be no guarantee this aim will be achieved. Furthermore, the actual volatility of the Fund may be above or below the expected range, and may also exceed its maximum expected volatility. A capital loss of some or all of the amount invested may occur.

- Emerging markets risk – less developed countries may face more political, economic or structural challenges than developed countries.

- Credit risk – the issuer of a bond or a similar investment within the Fund may not pay income or repay capital to the Fund when due. Bonds which are rated below investment grade are considered to have a higher risk exposure with respect to meeting their payment obligations.

- CoCos and other investments with loss absorbing features – the Fund may hold investments with loss-absorbing features, including up to 20% in contingent convertible bonds (CoCos). These investments may be subject to regulatory intervention and/or specific trigger events relating to regulatory capital levels falling to a pre-specified point. This is a different risk to traditional bonds and may result in their conversion to company shares, or a partial or total loss of value.

- Bond Connect Risk – The rules of the Bond Connect scheme may not always permit the Fund to sell its assets, and may cause the Fund to suffer losses on an investment.

- Interest rate risk – investments in bonds are affected by interest rates and inflation trends which may affect the value of the Fund.

- Liquidity risk – some investments may become hard to value or sell at a desired time and price. In extreme circumstances this may affect the Fund’s ability to meet redemption requests upon demand.

- Derivative risk – the Fund uses derivatives to generate returns and/or to reduce costs and the overall risk of the Fund. Using derivatives can involve a higher level of risk. A small movement in the price of an underlying investment may result in a disproportionately large movement in the price of the derivative investment. Derivatives also involve counterparty risk where the institutions acting as counterparty to derivatives may not meet their contractual obligations.

- Currency risk – the Fund can be exposed to different currencies. The value of your shares may rise and fall as a result of exchange rate movements.

- The Fund may be more than 35% invested in Government and public securities. These can be issued by other countries and Governments. Your attention is drawn to the stated investment policy which is set out in the Fund’s prospectus.