The backdrop of low interest rates continues to bode well for real estate investing as investors search for the potential incremental yield available over traditional fixed income.

“The hunt for yield and the under-allocation to alternative assets in many investor portfolios in the region offer significant potential to capitalise on the benefits of a direct global real estate allocation through a single investment,” said Henry Chui, managing director and head of private wealth for Nuveen in Asia Pacific.

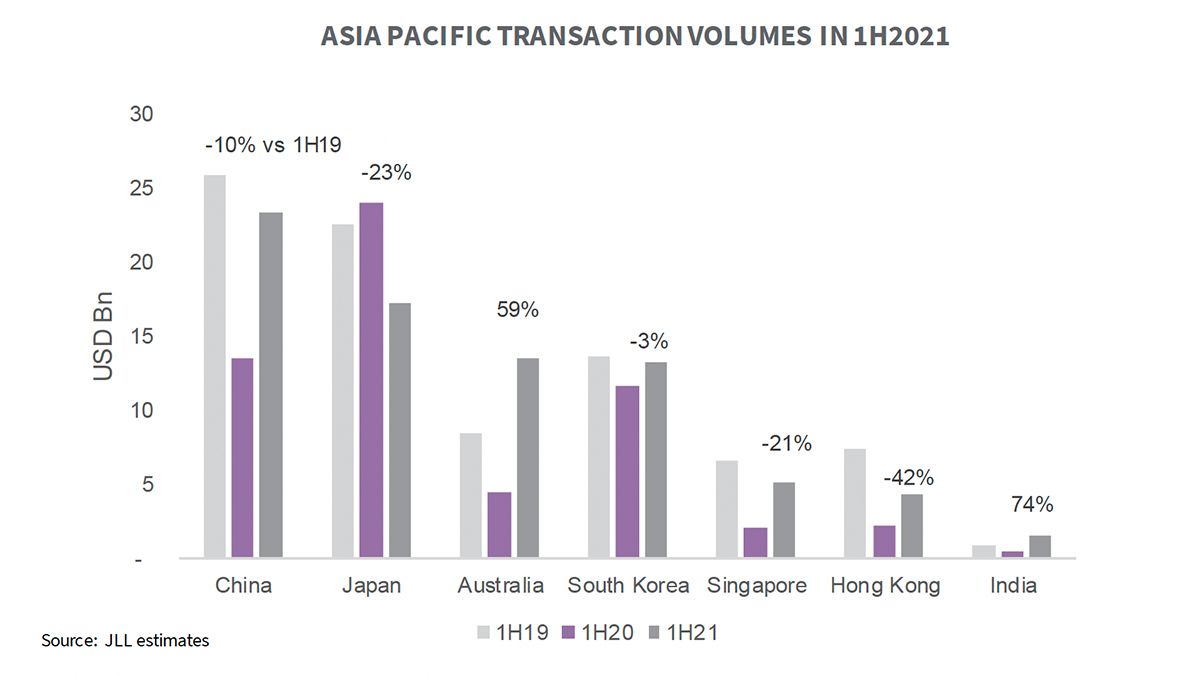

Industry data reinforces this trend. According to JLL, for example, direct real estate transactions in Asia Pacific reached $83.5bn for the first half of 2021 – only 6% lower than the first half of 2019. By the end of the year, the real estate firm has predicted investment volumes to rise 15% to 20%.

Investment sentiment has continued to strengthen with the vaccine rollout amid the resurgence of Covid-19 in selected parts of the region, such as Australia, Japan, China and South Korea.

“Commercial real estate transaction volume totalled $40.3bn, representing a 25% increase when compared with the same period in 2019,” added Louise Kavanagh, chief investment officer and head of funds management for Asia Pacific at Nuveen, citing CBRE data. “This demonstrates the long-term resilience and favourability of real estate investment in Asia.”

The asset class is notable for performing well during periods of economic growth and moderate inflation. And amid an inflationary scenario, the asset class tend to do well as rents increase when the economy is stronger.[1]

“Higher interest rates have not necessarily resulted in lower property values and total returns because rents tend to increase in a stronger economic environment,” explained Chui. “Thus, if the economy is doing better and interest rates are moving higher as a result of better economic growth, this can be positive for real estate.”

Indeed, monetary policies across Asia Pacific have translated to a highly supportive and liquid market for both domestic and overseas buyers. “Core products remain in strong demand,” said Kavanagh. “Australia has seen strong office investment momentum, driven by local investor demand. Across the wider region, sectors such as logistics, data centres and multi-family sectors have continued to be highly sought after given their income stability and sector tailwinds.”

At the same time, while the outlook for inflation combined with rate expectations are key factors in determining the directionality of real estate, investors that are building a real estate portfolio should focus on diversification as different real estate types do better in different parts of the economic cycle. “Further, real estate is a very localised business, so it’s not enough to just take an asset class or sector view,” Chui added. “Instead, each property should be assessed individually.”

Looking in new places

Inevitably, being selective is the best approach in an investment climate characterised by both ongoing uncertainty as well as a shift in real estate focus due to the acceleration of online shopping amid Covid-19.

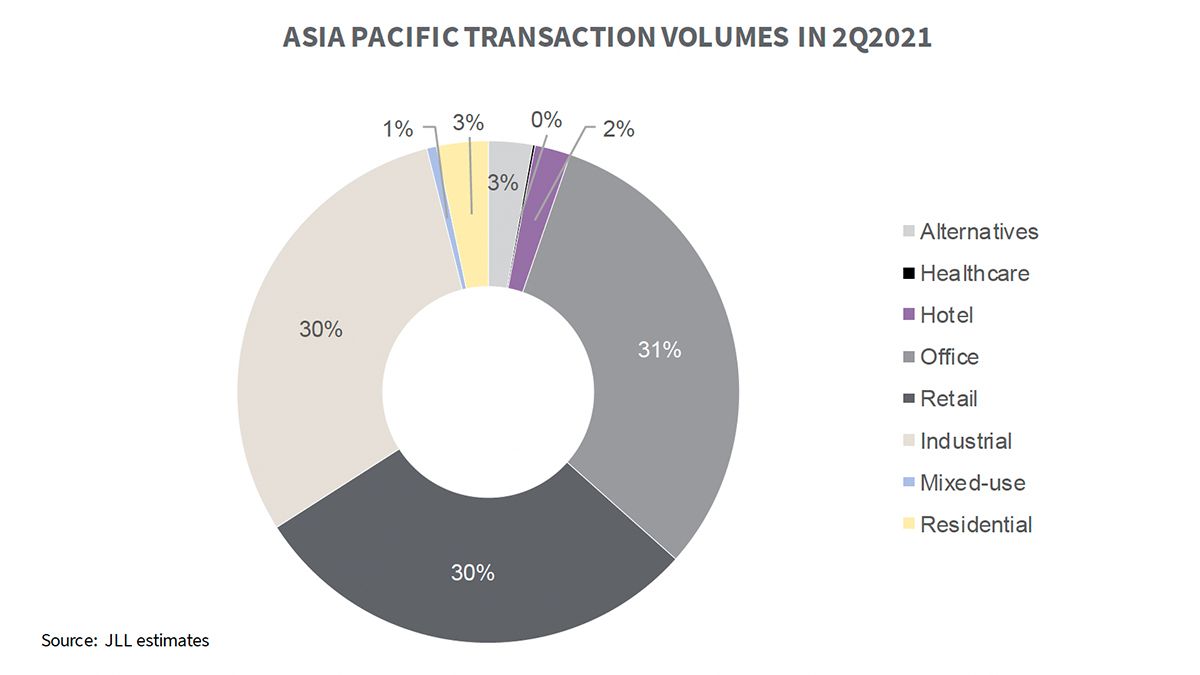

JLL’s capital tracking analysis shows the majority of transactions to date this year have been in office, logistics and industrial, as investors look for opportunities in the reallocation of their portfolios.

These are underpinned by demographic and thematic drivers. “Asia houses some of the most advanced e-commerce markets, while major countries in the region have either transformed or are in the process of doing so from being production- and trade-led to consumption-led service economies,” explained Kavanagh. “Both structural factors had already resulted in the significantly changed logistics occupier profile.”

Post-lockdown evidence also suggests the Covid-induced preference for shopping online seems to be stickier in Asia Pacific than elsewhere, meaning the surge in demand seen in 2020 from ecommerce players and third-party logistics operators is likely to be more sustainable in the region.

In addition, Chui identifies emerging sectors within the regional and global real estate landscape that warrant more attention.

For instance, in the US, single family homes are seeing a surge in demand, especially among ageing millennials, which form the second largest group in the country’s workforce, at roughly 35%. “They were previously happy living in cities, but there is an affordability crisis with rising house prices, combined with less pressure to be close to work,” he explained. “This is leading families to look for more space and therefore move out of the cities.”

New opportunities are also materialising in terms of medical facilities such as life science buildings and laboratories. This has been spurred by the wave of new technologies and research to drive the development of new drugs. “Life science buildings also have quite specific real estate demands. They tend to cluster in similar areas as they want to be near each other, plus they need higher ceilings, tailored floorplans and better ventilation systems,” said Chui.

Data centres are also hot property, in line with the rapidly growing number of connected devices. Research by CBRE emphasises the growing demand for data centres. Its “Asia Pacific Data Centre Trends H1 2021” report forecasts another record year for the sector. This is based on the $1.8bn in direct data centre investments in the first six months – 80% of 2020’s full-year investment volume in these assets.

New access options

Beyond specific sectors capitalising on wider structural and demographic shifts, investors can diversify their real estate portfolios by tapping into opportunities previously difficult for individual investors to access.

Certain types of real estate vehicles such as real estate investment trusts (REITs) are a good example. “They are an innovative way for investors to gain exposure to real estate that is driven much more by valuations,” said Chui. “They also enable investors to get more liquidity in an otherwise illiquid asset class.”

In addition to portfolio diversification, these instruments generally offer stability in terms of income stream through monthly or quarterly distributions.

Enhancing liquidity and efficiency

Ever-greater investor comfort and appetite in global real estate is also paving the way for collaborations that enhance access for HNWIs to these assets, and in more liquid and efficient ways.

With this in mind, Nuveen has spearheaded a partnership with Altive, the alternative investment fintech platform funded by Pacific Century Group.

This initiative enables the $1.2bn investment manager to provide regional clients with the potential to benefit from income and growth from direct investments across those commercial property types and geographies most likely to benefit from trends in technology, ageing populations and urbanisation.

“The current investment climate continues to provide attractive entry points into real estate, especially in assets that offer income generation and stable distributable income anchored on long-term structural growth,” added Chui.

Click here to learn more about what Nuveen offers in real estate, as well as across a range of other alternative investments.

*********************

[1] Past performance is no guarantee of future results.

GAR-1890699CR-O1121X

The views and opinions expressed are for informational and educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions, legal and regulatory developments, additional risks and uncertainties and may not come to pass. This material may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections, forecasts, estimates of market returns, and proposed or expected portfolio composition. Any changes to assumptions that may have been made in preparing this material could have a material impact on the information presented herein by way of example. Past performance is no guarantee of future results. Investing involves risk; principal loss is possible.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.