HSBC Private Banking’s (HSBC PB) has favoured equities over fixed income on the back of an expected sharp and broad pick-up in economic activity, as the accelerating vaccine rollout is bringing light to the end of the pandemic tunnel, according to the bank’s latest investment outlook for 2021.

“Markets are positive about the growth outlook, and they are right to be,” said Willem Sels, HSBC PB’s global chief investment officer, in the report.

The market has been looking ahead. For example, the S&P 500 Index has climbed 7.3% year-to-date.

With the expectation of a broad-based economic growth, the bank is overweight on cyclical sectors, including industrials, materials and financials.

It also recommends investors increase exposure to small- and mid-cap stocks, as they often profit from a local economic recovery.

DIVERSIFYING AWAY FROM TECH

According to the report, HSBC PB diversified its sector exposures away from technology since mid-2020, as valuations of the sector have become more expensive relative to others. An improving economy should also provide growth opportunities in other sectors.

However, it noted that investors should not completely abandon technology.

“Fleeing from tech is not rational,” Sels said, pointing to some investors moving away from growth stocks into value stocks due to a recent spike in US treasury yields. Treasuries suffered from weeks of sell-off, with the 10-year benchmark rate jumping to a 14-month high of 1.74% on March 19 from 1.09% in early February, before lowering to 1.67% last Friday.

Earnings in some technology names are solid, and are expected to provide investment opportunities even after lockdowns end.

For HSBC PB, technology is one of the “top trends for investors”. It recommends diversifying outside of US large-cap stocks, such as opportunities in Asia and tech-related companies in other sectors, including health technology, automation, and 5G.

Overall, the bank’s top picks within the equities space are China, the US and the UK, where it expects the economic rebound to be the fastest. It favours China’s digital consumption, technology hardware, high-end manufacturing, electric vehicles, and materials sectors. The bank also thinks South Korea will benefit from strong semiconductor and tech activity, and the regional financial hub Singapore will ride on the global growth.

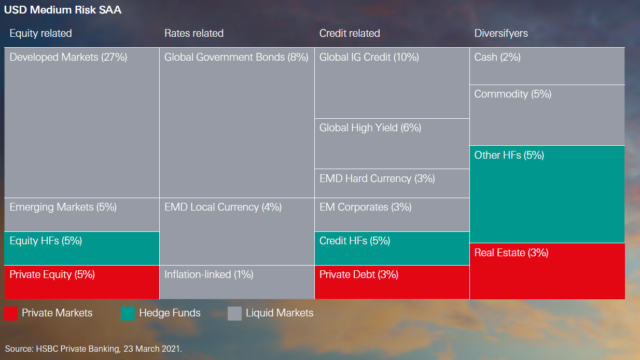

To cope with the short-term rate volatility, the bank recommends diversifying bond portfolios and incorporating positions like financials stocks, which can benefit from higher rates and rising dividends. The bank says it has increased bond allocation to quality emerging market high yield debt, which is more resilient to interest rate volatility than emerging market investment grade bonds.

The bank deems Asian credits to benefit the most from accelerating economic growth. China remains its top pick in Asia, both in local currency (LC) and hard currency (HC). Other attractive areas include Brazilian HC bonds and LC debt in Russia, Brazil and Mexico.