Speaker

Harry Thomas

Co-portfolio manager, TT Environmental Solutions Equities, TT International

Harry is co-portfolio manager for the TT Environmental Solutions Strategy and a Emerging Market equity senior analyst. Prior to joining TT in 2012, Harry worked at UBS in Emerging EMEA Equity Sales. Harry graduated from the University of Oxford with an MA in Philosophy, Politics and Economics.

Harry is a passionate ecologist and obtained an MSc in Forestry from Bangor University, which is amongst the top universities globally for studies in Agriculture and Forestry. Topics covered included: Forest Ecology and Resources; Forest Management and Planning; and Agroforestry Systems & Practises.

Company profile

TT International is a specialist asset manager devoted solely to managing high-conviction, concentrated active investment portfolios. With over 30 years’ experience, TT now manages many billions of dollars across long-only equity mandates (notably Global Environmental, Global Emerging Markets, Asia ex Japan, China Focus) and hedge funds for a diverse range of sophisticated investors across the world, including prominent Asian Sovereign Wealth Funds.

Everything TT does aims to produce attractive risk-adjusted returns for investors. A strong alignment of interests is achieved through both portfolio manager and employees of the firm investing their own assets alongside those of clients. To help ensure consistent alpha generation is achievable, the firm imposes capacity constraints across all strategies and success is measured by alpha generation rather than asset gathering.

VIRTUAL EVENT

Watch the Spotlight On: ESG panel discussions – Now available on-demand

Strategy presentation

Co-PM of TT’s Environmental Solutions Fund, Harry Thomas and TT’s head of ESG, Basak Yeltekin discuss how they think about environmental equities and how TT’s approach is designed to capture the full opportunity set in what we expect will be one of the leading structural growth thematics of a generation.

Fund profile

We believe that environmental investing will be the defining structural growth opportunity for investors in the coming decades, driven by rapid changes in the behaviour of consumers, corporates, governments and investors. This is a pure play global environmental strategy with an extremely high hurdle for portfolio inclusion, that aims to fully capture this opportunity and drive capital towards companies that are providing solutions to the problems of climate change and ecosystem destruction around the world. It features strong top-down/bottom-up linkage, with rigorous company analysis leading to a high-conviction 30-40 stock portfolio that is well diversified across opportunity set, geography and market cap.

Fund Size: $38m

Domicile: Dublin, Ireland (UCITS)

Top 5 holdings with maturity and weighting

| Holding | Weighting |

| Weyerhauser | 5.05% |

| Terna Energy | 5.05% |

| Delta Electronics | 4.83% |

| Alstom | 4.83% |

| Omega Geracao | 4.69% |

Data as at 28/02/2021

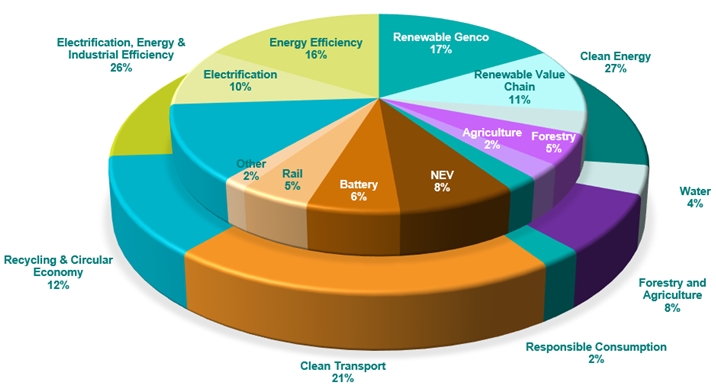

Portfolio’s exposure by thematic and sub-thematic

Data as at 28/02/2021

Sales contacts