“Has the Chinese Zodiac ever seemed more appropriate?”, asked a value portfolio manager of Spy this week over a very large glass of Aussie Shiraz. The Year of the Ox is almost upon us and it already feels more like a bull in a china shop, to, er, coin a phrase. For sure, old certainties are being smashed to pieces. Businesses built over generations in the travel and hospitality sector are on their knees, while start-ups with not much more than a business card and a domain name are pulling in billions. Hedge funds, the darlings of sophisticated investors, are being shunned like a ginger-haired stepchild. “When financial markets become more exciting than a Twitch feed or Netflix drama, be worried, be very worried indeed”, mused Spy’s sceptical drinking companion and Spy found it hard not to disagree.

Big Data is simply not Big enough for 2021. This month Franklin Templeton launched the Franklin Exponential Data ETF, ticker XDAT. The ETF is not passive, holding just 53 stocks and will be managed very actively. While the usual suspects of Facebook, Google and Twitter are in there, the manager is also betting on firms you may not have heard of such as Datadog (Cloud monitoring) and Zscaler (Cloud and network security) among many others. If there one thing Spy is convinced of: we are not entering an era of less data.

Spy took at a peak at how DBS fund recommendations were holding up over the last year. There are plenty of decent performers, for sure. Their list currently has 612 funds, including different currency classes. Of the top 24 performers, however, only one is actually on the Focus list. It is the Goldman Sachs Global Millennials Equity Portfolio, which is up a very healthy 57% over the last year. The best performer, however, is Nikko’s Shenton, Emerging Enterprise Discovery Fund. The fund is really a small to mid-cap Asia ex-Japan fund that is quietly blowing the lights out. It is up 80% over the last year. The fund is no spring chicken, it was launched in 1998.

The Asian wealth juggernaut continues, especially if you happen to be a large bank headquartered in Switzerland. UBS had its results out this week and the numbers were pretty staggering. The firm added $110bn in AUM to reach $560bn in Asia. This was record growth of assets and pre-tax profits during a crazy year of pandemic pain. It is hard not be impressed by the giant that is growing with the speed of a silicon valley start-up.

Was this the week the markets finally went stir crazy and all sense of reality departed? For the neutral observer, there has not been a more fascinating time in market history since the GFC. Stocks going completely wild in epic short squeezes, hedge funds getting crushed, brokerage firms banning trades in certain stocks causing lawsuits and outrage, the White House forced to comment; and we still have one more trading session to go! GameStop has been the poster child of this lunacy. It does not seem to matter a jot that the company has actually lost $1.5bn in the last 3 years, the Reddit and RobinHood people will buy what the people will buy. Spy knows that this is going to end very, very badly for many deluded retail investors but along the way they seem to be achieving something even more unlikely, giving professional investors the kicking of a lifetime. One Twitter wag commented, “I know this GameStop stuff is funny, but you have to remember this is hurting real people who own multiple boats”.

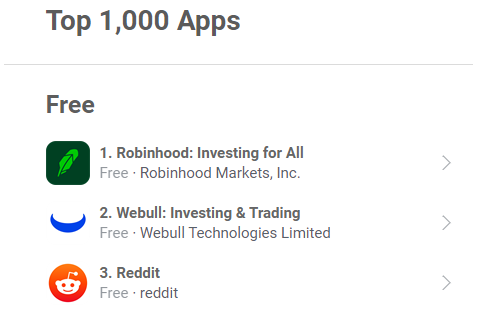

Sometimes a snapshot is worth a 1000 words. Top apps downloaded in the App Store this week. This is way beyond hearing tips from your barber, taxi driver or masseuse. Full blown market mania.

How do you spell ‘frenzy’ in language that Wall Street actually understands? You could start with the SPAC figures. US SPACs (special purpose acquisition companies), IPO capital raised:

2013: $1 billion

2014: $2 billion

2015: $4 billion

2016: $3 billion

2017: $11 billion

2018: $9 billion

2019: $13 billion

2020: $83 billion

2021 YTD: $24 billion in less than a month.

There is even talk of WeWork coming to market through a SPAC soon. We know how the industry likes to present annualised figures when things are going well. That would be $270bn raised for the year, if this carries on like this, calculates Spy.

Spy would imagine there must be some short-sellers who hear the echoes of John Meynard Keynes in their ears, “The market can stay irrational longer than you can stay solvent.”

Spy has been scouring the web for interesting asset and wealth management promos and adverts of late. He came across one from DBS Treasures on SCMP.com that raised an eyebrow. It was promoting offshore accounts and services in Singapore to Hong Kongers. DBS’s blurb says it is ideal to “set up a family office to manage assets if one wants to diversify assets across jurisdictions.” Spy would imagine, there are a great deal of Hong Kongers contemplating just such ‘jurisdictional diversifications’ at the moment.

Spy’s photographers have been out and about in Singapore and actually spotted some outdoor advertising. Franklin Templeton has been asking clients to step up to a different future. Well, that certainly feels true for Spy.

Also in Singapore, BNP Paribas has been encouraging investors to think about energy and where it is all going. This has been targeting retail investors online.

Until next week…