“We have entered the greed phase”, an Australian private banker based in Hong Kong told Spy this week. He could have been referring to our third order of Hibiki Harmony whisky, but he wasn’t. Apparently, clients have been phoning non-stop to place buy orders for almost everything. FOMO does not even begin to capture it. “Frenzy” was the word he used. “This can go on for a long time”, he mused, “but not forever.” On cue, David Einhorn pointed out this week that a tiny company, a penny stock, named Hometown International, is now valued at $100m+ despite having a single delicatessen as its only business with a turnover of less than $30,000. Something pretty bonkers is going on out there, reckons Spy.

If you are going to launch a new business, it helps to have a snappy name, reckons Spy. Hat tip to Temasek and BlackRock for “Sustainability Partners”. This new joint-venture is starting out with a modest $600m “to make investments in early-stage growth companies targeting proven, next-generation renewable and mobility technology including emerging fuel sources, grid solutions, battery storage, and electric and autonomous vehicle technologies as well as in building and manufacturing sectors to drive decarbonisation, resource efficiencies, and material and process innovation.” Phew! With such a broad remit, Spy sincerely doubts that $600m will not be joined by new dollars soon.

Do you remember those halcyon days when consultants used to push the line that all-tech, no-human, robo-advisers were the future? Spy never bought the hype, to be fair. When it comes to money, people want to speak to a human, especially when things go wrong. Spy spotted an advert by one of Singapore’s leading robo-advisers, Stashaway. The message? “Speak to an advisor”. If Spy’s memory serves correctly, Schroders acquired a stake in Stashaway and that is a firm that has always believed in the value of speaking to a wealth manager.

Spy may be a tad cynical, but as the asset management industry comes round to Crypto, one can’t help but wonder whether fees have anything to do with it? Take the largest ETFs focusing on the mainstream equities: SPDR’s $SPY, iShares’s $IVV, Vanguard’s $VTI, and $VOO. They generate a combined $554 million in annual fees on about $1.08 trillion in AuM ($SPY charges 0.0945%, the other three a minuscule 0.03%.) Now, compare that to the Grayscale Bitcoin Trust. It manages to charge 2% and generates $786m in fees on just $39.3bn in AuM. Figures that makes one go Hmmm.

As of yesterday, 96.4% of stocks in the S&P 500 closed above their 200-day moving average today, the highest percentage ever, according to Charlie Bilelio. (Data to hand only goes back to 2002). Spy, therefore, took a peek at which fund houses in the US Large Cap space have been blowing the lights out. HSBC’s Economic Scale fund up 69% in the last year, Natixis’s boutique, Harris Associates’ US Equity is up 70%. However, leading the pack according to Morningstar is Legg Mason’s Clearbridge Value Fund up a whopping 76%. The momentum is all with the bulls.

Well, it took until this week, but the US SPAC market has managed to raise $100bn in 2021. That is just $5bn less than 2020, 2019 and 2018 combined. In 2013 it was a mere $1bn. Spy hardly needs to remind his sophisticated readers that a SPAC is nothing more than a blank cheque company looking for something to buy, anything to buy. By the way, the evidence is beginning to creep in that traditional IPOs do better for investors than direct-to-market SPAC listings. Grab investors take note, reckons Spy.

While Citibank grabbed some headlines with its decision to exit many Asian markets for its retail banking platform, what did not surprise Spy was its explicit decision to NOT exit highly profitable wealth management activities across Asia. Singapore and Hong Kong retail banks are staying put and so is its enormous wealth management machine. Independent asset managers must have breathed a sigh of relief. Citi remains one of the most open of all fund distributors, willing to take on new strategies and use its enormous power to build assets rapidly. The thought of it going to into an owner that favours in-house products would have been an Asian industry nightmare.

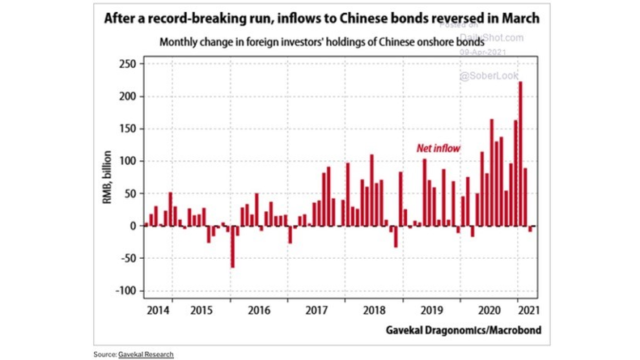

The Huarong Asset Management scandal in China seems to grow and grow. Nobody will accuse China of not displaying its unhappiness in the situation. Executing the manager’s former Chairman, Lai Xiaomin, for fraud and bribery, sends the starkest signal yet that the country will not tolerate abuse of state resources. Spy is reminded of Voltaire’s famous quote, “In England, they execute a General every now and then to encourage the others.” Nonetheless, whispers that the company may go bankrupt keep swirling, giving foreign bond holders some sleepless nights. Figures just out confirm that after a record-breaking run, investors became net sellers of Chinese bonds in March for the first time in a year.

Speaking of fraud, Bernie Madoff’s death in prison this week reminded everyone that if an investment is too good to be true, it probably isn’t. Yet, in Singapore this week, investors are now, apparently, surprised at the arrest of Ng Yu Zhi, the trader with an extravagantly lavish lifestyle who seems to have swindled investors out of S$1bn ($750m) by promising quarterly gains of 15%. Spy knows Singaporeans have aggressive return expectations, but even the most excitable Lion City investor must have smelled a 60%-a-year rat, surely?

If you were a policymaker and central banker from out of space and you arrived at a new planet and were told the following: The local housing market is on fire with prices soaring and average homes at an all-time high; stock markets are at all-time highs; inflation expectations are at 13-year highs and shiny new digital currencies called cryptos are parabolic, would you A) raise interest rates a little or B) keep them suppressed at record lows? Answers to Spy on a postcard, please.

Until next week…