In the Covid-on scenario, the US firm envisages growth stocks, large-caps, and US equities continuing to outperform value, small-caps, and non-US stocks.

In Covid-off, it anticipates a fast and substantial rotation, in favour of the more typical economic recovery trade that tends to favour small caps, value stocks and credit.

“While the destination is Covid-off sometime in 2021, the path will see bouts of Covid-on creating volatility along the way,” Thomas Poullaouec, T. Rowe Price’s head of multi-asset solutions for Asia-Pacific, told a media webinar on Wednesday.

“Investors should remain diversified between growth and value, and take advantage of cheap cyclicality in small caps, high yield and emerging markets,” he said.

“On a relative basis, we believe stocks are less expensive than US Treasuries, hence the equity risk premium is alive and well,” he added.

Government bonds may not offer as much diversification to investors’ portfolios going forward and new diversifiers like alternatives and risk managed overlays are required in a balanced portfolio

Meanwhile, the search for yield will continue as government bond rates are likely to remain low.

Poullaouec favours a mixture of short-dated high yield credit, investment grade bonds with longer duration, safe-haven currencies (such as the yen and Swiss franc) and alternative, cash plus strategies.

In this environment, Poullaouec also believes that Asia-Pacific assets should do well because the suppression of the coronavirus has been more effective in the region, making the path to the COVID-off environment less dependent on the success of the vaccine rollout.

Moreover, the economic momentum has started and is likely to expand further thanks to the pent-up demand from domestic consumption and the recovery in global trade, he said.

Asian corporate bonds are likely to attract further inflows because of their lower duration profile and the higher yields compared with US and European credit, while Asian currencies should appreciate against a US dollar weakened by low interest rates.

POST-PANDEMIC BOOST FOR ASIAN EQUITIES

Anh Lu, portfolio manager for Asia ex-Japan Equity strategy at T Rowe Price, also remains positive on the medium- to long-term outlook for Asia ex-Japan equities.

Despite strong year-to-date performance, she believes Asian markets offer attractive risk-rewards relative to global markets and compared with historical averages from a valuation perspective.

“We focus on high-quality companies with solid balance sheets, strong managements and superior businesses models benefitting from cyclical recovery as the success of Covid-19 vaccines becomes more apparent,” said Lu.

In particular, strong domestic consumption should boost the corporate earnings of cyclical sectors in India and Southeast Asia, as it already has in China, she said.

Lu manages the $788m T Rowe Price Asian Ex Japan Equities Fund, which has a four-star and four-crown ratings from Morningstar and FE Fundinfo, respectively.

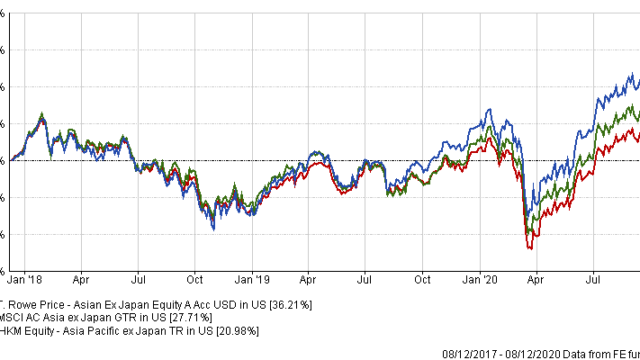

The fund has posted a three-year cumulative return of 36.21%, outperforming the MSCI AC Asia ex-Japan index (27.71%) and the average of similar products available to Hong Kong investors (20.98%), according to FE Fundinfo.

It has generated 4.09 of alpha during the period, and although it has been more volatile (19.58%) than its benchmark (19.15%) and its peers (18.21%), it has a superior Sharpe ratio (0.38), FE Fundinfo data shows.

The fund’s significant country overweights are India and Hong Kong and it is underweight South Korea relative to its benchmark. Sector overweights include consumer staples and IT, and it is underweight materials, energy and healthcare, according to the latest factsheet.

While there are pockets of very expensive stocks (so-called hyper growth sectors, such as biotech, Chinese technology companies, EV thematics and software firms), Lu argued that many high-quality growth businesses are still trading at reasonable multiples.

“We also find good value in some of the cyclical stocks that were hit hard by Covid-19, but which we think will emerge just as strong or even stronger after the pandemic,” she said.

These tend to be companies that suffered a short, sharp cyclical downturn, but should enjoy a strong recovery in 2021-22, with upward earnings revisions as the vaccine roll out progresses.

However, she does not expect a broad-based re-rating in 2021 unless the global liquidity environment becomes even more supportive – so the focus will be on earnings growth, which could reach 25% year-on-year.

According to Poullaouec, the main risks to this optimistic Asian outlook largely revolves around a policy misstep (such as tightening too quickly), an unforeseen resurgence of the pandemic in the region postponing the recovery or a delay in the availability of the vaccines in the region.

T Rowe Price Asian Ex Japan Equity Fund vs MSCI AC Asia ex-Japan index and sector average

Source: FE Fundinfo. Three-year cumulative returns in US dollars.