Rather than get swept up in the pessimism that is defining the current global market environment, investors should look to several factors as reasons to be positive.

“It’s not ideal to have such a high level of inflation and such an aggressive tightening underway for many developed market central banks, but I’d argue we are in a far better place than we were two years ago,” said Kristina Hooper, chief global market strategist at Invesco.

Among the drivers behind her view are the decreasing pressure on global supply chains, bright spots in recent inflation data and the solid rebound in China’s economic growth in June.

Positive feelings returning

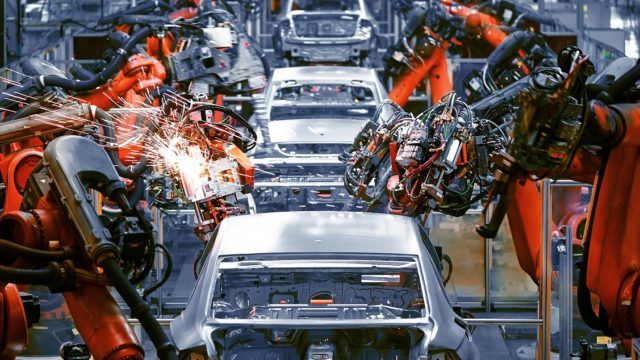

From a supply chain perspective, the decline in the Global Supply Chain Pressure Index over the past month or so mostly followed an improvement in China supply delivery times post-lockdown.

“This indicates that at least one inflationary pressure is easing,” explained Hooper.

At the same time, commodity prices are on the decline. While still elevated, both the Goldman Sachs Commodity Index and the Bloomberg Commodity Index are down from their peaks.

In turn, Invesco believes this should moderate the rate of increase in the goods portion of the US Producer Price Index (PPI), suggesting that goods inflation is also likely to moderate sometime soon.

Other bright spots exist in recent inflation data. For example, said Hooper, although headline US Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) each rose in their last report, core CPI and PCE growth – which exclude food and energy prices – have recently declined slightly.

Further, Hooper considers longer-term US inflation expectations as becoming better anchored. This is according to five-year inflation expectations as measured by the University of Michigan survey, with the New York Fed Survey of Consumer Expectations showing similar results.

“[This] arguably could provide the Fed with the cover to not tighten policy so significantly that a recession ensues,” she added.

Momentum in China

Positive economic signs are also emerging in China, to fuel general investor sentiment.

For instance, despite the disappointing second-quarter economic growth, it broadly rebounded in June as pandemic restrictions eased.

“We continue to expect an economic recovery in the second half, led by industrial production and infrastructure investments due to pro-growth policies,” said Hooper.

This reflects the improving Covid-19 situation in China, with cities reopening and economic activity resuming.

Worries about increases in infection rates will continue, but Hooper doubts further lockdowns will occur given China’s Covid policy has evolved and adapted in recent months to a more dynamic approach.

Looking towards markets globally, meanwhile, Hooper is also expecting positive surprises to be more powerful.

“Stocks have been beaten down. That doesn’t mean we won’t see more downside for some stock markets around the world…. But I believe we are far closer to the bottom than the top, and meaningful positive catalysts could present themselves in coming months,” she explained.