China Asset Management in Hong Kong has received approval from the Securities and Futures Commission (SFC) on Monday to launch the ChinaAMC Hang Seng Hong Kong Biotech Index ETF, according to the regulator’s records.

The product will be listed on the Hong Kong Exchange and Clearing (HKEX) on 18 March. It will be the first ETF in the SAR to track the performance of the Hang Seng Hong Kong-Listed Biotech Index, which was launched in December 2019.

The index includes main board-listed securities on the HKEX that are classified as “biotechnology”, “pharmaceuticals”, and “medical devices” in the Hang Seng industry classification system, according to the index provider.

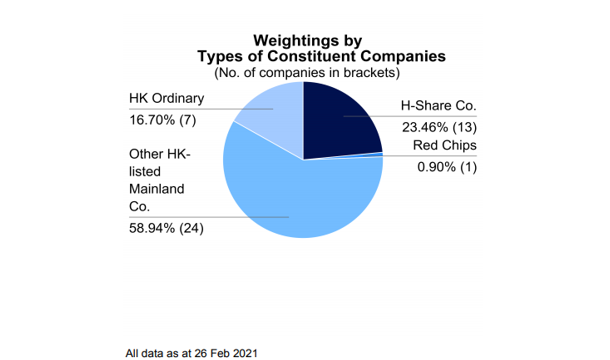

Hang Seng Hong Kong-Listed Biotech Index’s weightings by types of constituent companies

Hang Seng Hong Kong-Listed Biotech Index’s top five company weightings

| Company Name | Industry Classification | Weighting (%) |

| Wuxi Bio | Healthcare | 10.20 |

| Innovent Bio | Healthcare | 9.73 |

| Ali Health | Healthcare | 9.65 |

| Sino Biopharm | Healthcare | 9.45 |

| CSPC Pharma | Healthcare | 7.03 |

China AMC’s new product will be the second biotech-focused ETF in Hong Kong. The other is Mirae Asset Global Investments’s Global X China Biotech ETF, which was listed on the HKEX in July 2019.

Tracking the Solactive China Biotech Index NTR, Mirae Asset’s ETF has assets of around HK$2.80bn ($360.9m), according to data from the HKEX. The index includes around 20 of the largest biotech and pharma-related companies that are listed in China, Hong Kong and the US.

Mirae Asset has become a leading player in the China thematic ETF space, launching nine such products since 2019. Two of them were just launched today, with one of them being the first actively-managed China A-share ETF in Hong Kong.

In total, China AMC has ten ETFs listed on the HKEX, including five leveraged and inverse products, according to data from the local bourse.